How does Reddit stack up to comparable platforms?

Is RDDT a moonshot?

Reddit has come out with an IPO and, inexplicably, numerous redditors from r/wallstreetbets, r/valueinvesting and other highly subscribed platforms are overtly set on the opinion that this is a stock that is shortable.

Arguments against Reddit are many:

Non-cash generating

No moat, just a forum

Ads aren’t as profitable

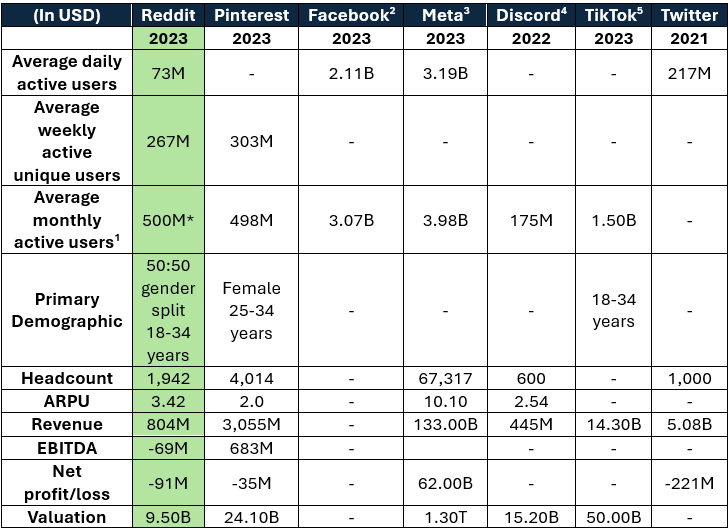

I wanted to go through other companies that are operating under a similar business model. Data is sourced mostly from 10K filings with the SEC and exceptions are cited.

1 Generally defined as unique users who come to the platform over the period of a month, averaged across the year for each month.

2 Inclusion of FB separately from Meta is just for illustrative purposes to provide additional context.

3 Only considered for Meta’s family of apps (not including other endeavors such as Realty labs).

4 Discord stats are gathered from alternate sources for 2020: Source.

5 TikTok stats are gathered from alternate sources for 2023: Source.

*Just December 2023, not averaged out over the year.

Observations

Reddit vs Discord: In terms of usage and nature of platform I view Reddit and Discord to be the most similar. Both have groups (subreddits vs discord servers) with highly interested and engaged userbase.

Reddit’s monthly active users (2023) is 2.8x that of Discord (2022). However, the valuation of Reddit (2023) is 0.63x that of Discord (2022). However, this is not a total like to like comparison since there would be PE inflation between 2022 and 2023. The other caveat is that Discord’s business model is fundamentally different from Reddit as the former does not rely on Ad revenue vs Reddit which relies heavily on Ad revenue.

However, despite the caveats, it appears that Reddit is undervalued compared to Discord, especially given the fact that Reddit is also anticipating significant revenues through utilizing their data for training AI models for different companies.

Reddit vs Pinterest: Business model wise, among the listed peers, Reddit would most closely represent Pinterest. Both currently rely on advertising revenue.

Reddit’s monthly active userbase is roughly equal to that of Pinterest and Reddit appears to be running a much leaner operation with a lower headcount. Reddit’s ARPU is higher than that of Pinterest’s by 70%. Despite this Reddit’s valuation is 0.39x that of Pinterest.

Given these facts, it still appears that Reddit is decently undervalued compared to Pinterest.

Reddit vs Meta: I do not believe there are a lot of similarities between Reddit and Meta, mostly because Meta is a full ecosystem of apps (Facebook, Threads, Instagram, Whatsapp). The number of monthly active users is astronomically higher for Meta’s family of apps vs Reddit. The ARPU is also significantly higher. Because of this I feel that we cannot take a confident predictive stance about Reddit based off of Meta’s numbers. I decided to include this information because it is interesting to me to see what a behemoth Meta truly is. Even if we account for bots and fake accounts (which according to Meta is about 10% of their userbase) Meta would still have around 3.0B unique users visiting the Meta’s family of apps every month. Or in other words that is about 37.5% of the world’s population visit Meta’s family of apps every month and touch their systems for one reason or another. I sincerely do not believe there are many moats out there that are like this.

Why were we crying about Meta’s investments in the Metaverse again? Shorting the stock, making it go to USD 100 in 2022? Were we stupid? And given the fact that I didn’t put all my life savings into Meta at that time, I’d say I am stupid. #End of rant

Reddit vs TikTok: Reddit and TikTok aren’t comparable in a qualitative sense. I would say the userbase has differing attention spans and are seeking a separate kind of engagement when they visit each platform.

Monthly active userbase of Reddit is 0.33x of TikTok. Derived ARPU (as I couldn’t find any reported numbers for ARPU) for TikTok (Revenue/Monthly Active Users) should be around USD 9.5, if we consider roughly the same users are visiting TikTok each month. This is ofcourse speculative and I won’t defend the number ever, but it seems like TikTok’s ARPU is comparable to Meta (USD 10.10 ARPU). This sounds reasonable and inline with my expectations.

For a platform that has 1/3rd the number of monhly active users and 1/3rd the number of revenue, Reddit’s valuation is ~0.2x that of TikTok. Whether that is a reasonable valuation is up for interpretation. I would say Reddit should be valued atleast at 1/3rd that of TikTok – around USD ~16B. However, I will be the first person to agree that this is highly speculative.

Reddit vs Twitter: Reddit and Twitter (or X) are not comparable qualitatively for obvious reasons. The intentions and use cases for the two platforms are very different.

Given the issues that Twitter is facing it is highly difficult for me to comment on the valuation situation. I would be happy to get comments on what your thoughts are about the two.

Why this pic? I don’t know - I just thought I’d honor the AI that made this by showcasing some of its best responses!

Final Thoughts

Valuation is more of an art than a science, and in this case, particularly, it is difficult to say how things can play out given the varying levels of monetization ability across the listed platforms. Discord for example manages quite well despite not relying on Ad revenue. Reddit might become the go to platform for training AI models given the depth of conversations the platform fosters.

Also, contrary to popular opinion I do feel that Reddit has a moat. This moat is built solely by the fact that Reddit has a vibrant user base that is more than willing to engage and spend time on the platform. Drawing from personal experiences, I haven’t spent as much time arguing about certain positions on any other platform as I have spent on Reddit. I believe it’ll be very difficult for a competing platform to do something similar especially given the fact that Reddit already does this as an incumbent and many have already tried and failed. Other platforms might emerge, catering to certain niches, but overall Reddit is an incredible consolidator of all niches imaginable.

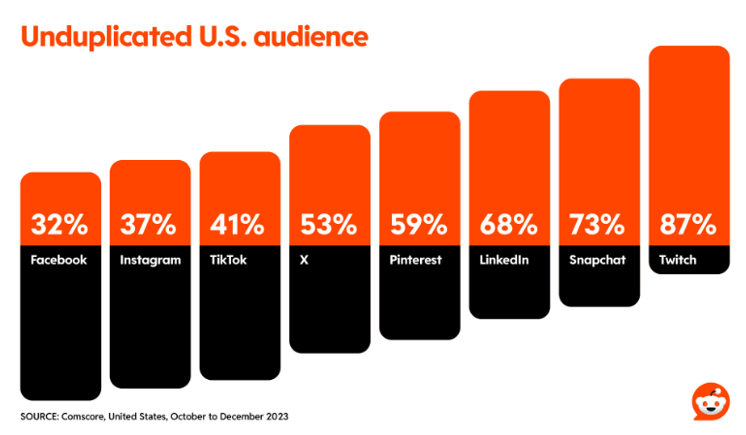

Apparently, Reddit also has a userbase that is majorly mutually exclusive with several other platforms.

Overall I think there is significant value in Reddit. I, too was part of the initial sentiment that Reddit is a questionable long buy (and it certainly does seem that way given the CEO sold 500k shares at USD 32.30), but I do think there is more to the story here. Atleast, if the numbers are to be believed then the fact that Reddit has value is obvious.

As far as the CEO selling shares, it is astonishing to me that he sold it at USD 32.30 - and the IPO was priced at USD 34. So, he could have made more money if he had just sold his shares at market price after the IPO. Was he that bearish that he was willing to part with the shares at a price lower than the IPO price? It seems more as if he was just cashing out as he needed cash for other purposes (like buying a yacht).

The other question I am unable to answer is that my analysis seems too optimistic. It screams value and yet the Investment Bankers who worked on this decided that the valuation was that low? I wonder what I am missing.

Obligatory: Don’t do what I say. I am probably wrong, and this is not financial advice. Nor do I have any licenses to be a financial advisor.